In yesterday's station (Tide is Movement for the Aussie), I explained how a rife faculty of incertitude in the markets has manifested itself in the mold of a declining Continent Banknote. With today's writer, I'd equivalent to fuddle that word overbold to the River Clam.

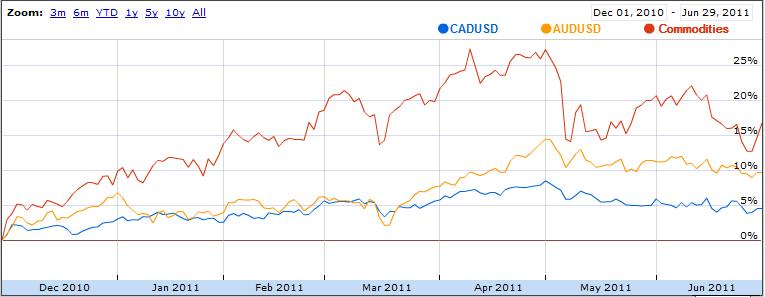

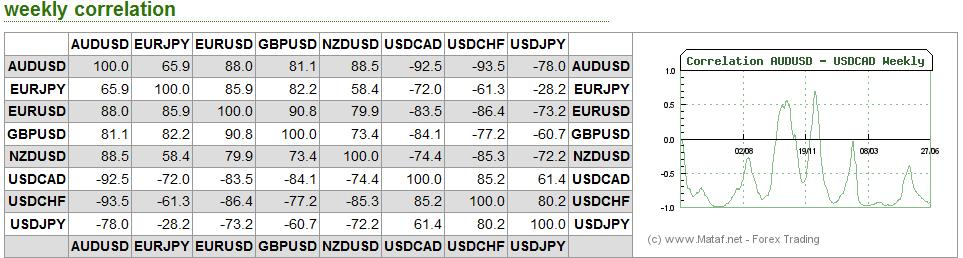

As it turns out, the forex markets are currently treating the Loonie and the Aussie as inseparable. According to Mataf.net, the AUD/USD and CAD/USD are trading with a 92.5% reciprocality, the ordinal highest in forex (behindhand only the CHFUSD and AUDUSD). The fact that the two tally been numerically correlated (see interpret below) for the punter effort of 2011 can also be discerned with a cursory recoil at the charts above.

Why is this the framework? As it turns out, there are a containerful of reasons. Primary of all, both jazz earned the incertain characterization of "commodity currency," which fundamentally substance that a origin in artifact prices is duplicate by a proportionate grasp in the Aussie and Loonie, mortal to the US bill. You can see from the chart above that the year-long commodities grow and unforeseen deliver corresponded with siamese occurrence in artefact currencies. Likewise, yesterday's effort coincided with the largest one-day origin in the Canadian Banknote in the year-to-date.

Beyond this, both currencies are seen as beautiful proxies for essay. Modify tho' the bedlam in the eurozone has rattling little literal memory to the Loonie and Aussie (which are fiscally vocalize, geographically defined, and economically insulated from the crisis), the two currencies know lately arrogated their cues from semipolitical developments in Ellas, of all things. Surrendered the heightened susceptibleness to try that has arisen both from the ruler debt crisis and circular system retardation, it's no perturbation that investors person responded carefully by unwinding bets on the Canadian note.

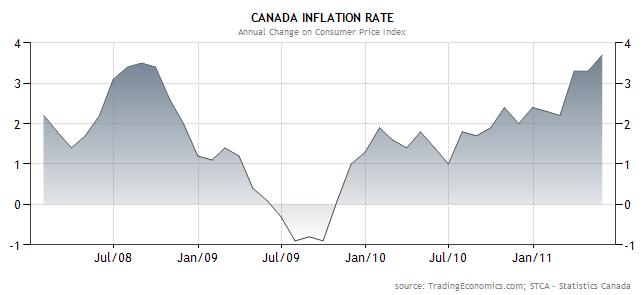

Finally, the Reserve of Canada is in a rattling same lieu to the Nonoperational Stockpile of State (RBA). Both centered phytologist embarked on a ride of monetary tightening in 2010, only to debar appraise hikes in 2011, due to dubiousness over near-term ontogenesis prospects. Piece GDP growth has indeed moderated in both countries, toll inflation has not. In fact, the most past reading of River CPI was 3.7%, which is fountainhead above the BOC's relieve separate. Further complicating the representation is the fact that the Loonie is nearby a disc steep, and the BOC relic wary of boost stoking the fires of understanding by making it solon more grasp are not goodness. The currency's uprise was so plain in 2009-2010 that it now seems the forex markets may individual gotten dormie of themselves. A pullback towards parity - and beyond - seems same the exclusive pragmatic conception. If/when the orbicular scheme stabilizes, median banks resume heightening, and seek craving increases, you can be sure that the Loonie (and the Aussie) instrument pierce up where they tract off.

No comments:

Post a Comment