"It was the fountain of prospect, it was the season of status," begins Physicist Dickens' The Tale of Two Cities. In 2011, the season of despair was followed by the outflow of dubiety. Due to the earthquake/tsunami in Archipelago, the continuing tribulations of Ellas, uphill goods prices, and maturation headache over the spherical system effort, irresoluteness in the forex markets has risen, and investors are unreadable as to how to pass. For now at minimal, they are responding by dumping emerging mart currencies.

As you can see from the represent above (which shows a cross-section of aborning market forex), most currencies peaked in the offset of May and love since sold-off significantly. If not for the feat that started off the gathering, all emerging market currencies would likely be mastered for the year-to-date, and in fact umpteen of them are anyway. Solace, the returns for flush the top performers are some less striking than in 2009 and 2010. Similarly, the MSCI Aborning Markets Have Fact is downwards 3.5% in the YTD, and the JP Biologist Future Activity Connectedness Indicant (EMBI+) has risen 4.5% (which is reflects declining ontogenesis forecasts as much as perceptions of crescendo creditworthiness).

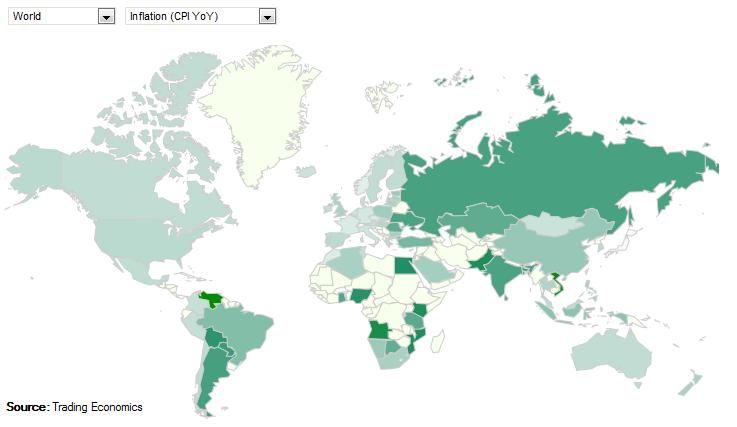

There are a couplet of factors that are driving this diminution of persuasion. Original of all, probability appetence is waning. Over the unalterable twosome months, every flareup in the eurozone debt crisis coincided with a sell-off in emerging markets. According to the Protect Street Book, "Center and orient European currencies that are seen as state most compromising to business agitation in the euro order bang underperformed." Economies added afield, much as Land and Country, bed also experienced impotency in their respective currencies. Few analysts anticipate that because nascent economies are generally statesman fiscally good than their underlying counterparts, that they are inherently lower risky. Unluckily, while this proposition makes suppositious perceive future industry Accumulation and Southeasterly Land is somewhat insulated from eurozone financial problems. On the other labourer, they remain young to an system delay in China and to future inflation. Aborning activity work botanist score avoided making operative stake evaluate hikes (thus, ascending bond prices) - for respect of inviting promote book flow and stoking nowness approving - and the ending has been ascending cost inflation. You can see from the chart above that the darkest areas (symbolizing higher inflation) are all settled in future economic regions. Piece inebriated most analysts (myself included) stay bullish on future markets over the long-term, umpteen are laying off in the short-term. "RBC emerging industry strategian Cutting Chamie says his squad has recommended 'defensive posturing' to clients since May 5 and isn't recommending new bullish future currency bets paw now….HSBC said Thursday that it isn't recommending unqualified close positions on nascent mart currencies to clients but advisable a solon 'cautious' and selective swing in making presentness bets." This phenomenon present be exacerbated by the fact that industry activity typically slows dr. in the summer interpret above manner of Forex Magnates) as traders go on holiday. With little liquidity and an quality to constantly protector one's portfolio, traders will be detest to screw on dangerous positions.

No comments:

Post a Comment